How to Calculate ROI of MBA program

An MBA degree may be the most secure educational path, but funding it is no easy task. We are all aware of the significant impact that student loan debt may have on the life of a young professional.; therefore, it is critical to gain a solid perspective before enrolling in an MBA program. Pursuing an MBA entails investing money, time, and effort. Is it worth investing in all three? It is indisputable that an MBA is a significant investment. This post will discuss all three aspects, such as whether you should invest, what you should invest in, and how to compute the ROI of an MBA program.

Here is the Snapshot of the article:

What is The Return on Investment of a Degree

Understanding the associated costs is crucial for degrees like MBAs. Candidates should know how quickly they can repay the debt, particularly when the amounts involved are substantial.

Return on investment (ROI) is a performance metric used to assess the efficiency or profitability of an investment or compare the efficiency of many projects. ROI attempts to directly determine the amount of return on a particular investment, in this case, an MBA program.

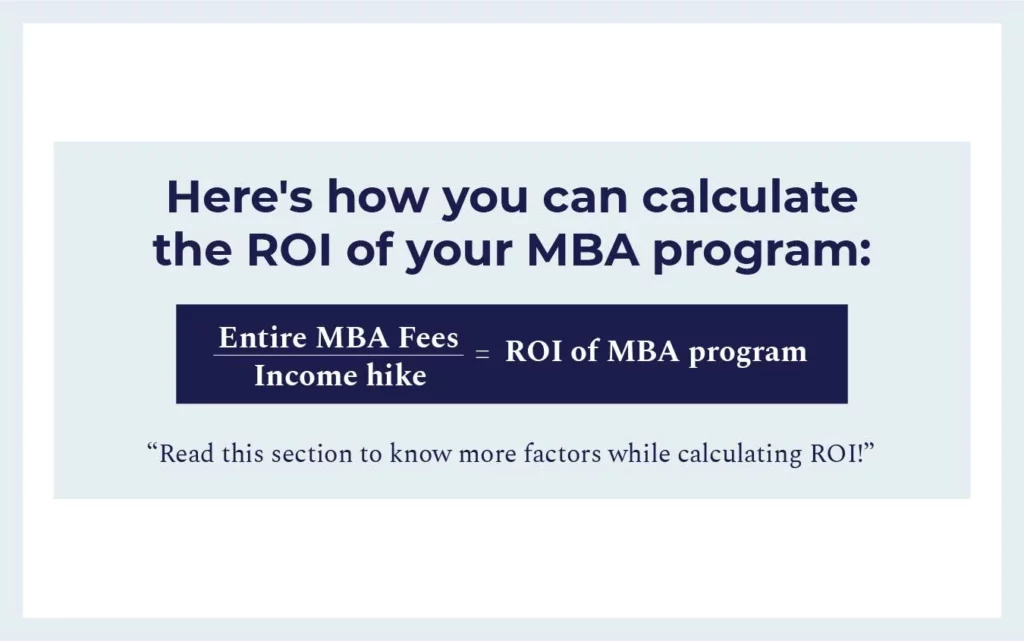

Measure the ROI of Your MBA Program

Predicting your initial salary and yearly income raises is simple and generally influenced by your relevant work experience, post-MBA knowledge, and job competence. Divide the entire tuition for your MBA by your wage increase to calculate the time it will take to pay off your loans. Your ROI begins to kick in after you’ve paid off your loans.

It seems a little frantic. That’s why we broke it down into a simple method for calculating your ROI, but first, you need to understand the primary components of an MBA’s ROI, and then you can set your math for doing the ROI.

How to Measure ROI of an MBA Program by Yourself

While a common approach to measuring the ROI of your MBA program involves estimating the yearly salary increase and payback period for your student loans, a more comprehensive analysis considers several other factors. Sure, pre-MBA experience, post-MBA salary bumps, and loan repayments are important. However, the true ROI of your MBA goes beyond recouping your initial investment within a set timeframe.

1. Make a note of the present salary.

2. Then, you’ll need to know the entire cost (fees and costs) of the MBA program and its duration.

3. Then figure out your opportunity cost. You will forego this salary, plus the program’s expenses while doing your MBA. If you foresee a pay raise or promotion during this period, you might figure out a salary increase.

4. Next, you should know your post-MBA income, which you may get on the school’s official website.

Now that you’ve gathered this information, there are a few basic steps you may take to compute an anticipated ROI for your MBA program.

Current Salary (Pre-MBA) – $60,000.

A two-year full-time MBA program costs $50,000 each year.

SALARY + FEE ( for two years full-time MBA )

$60,000*2 = $120,000

$50,000*2 = $100,000

Add both = $120,000+$100,000 = $220,000

Next comes your projected post-MBA salary; calculate it by the length of time it will take to repay the US$220,000. ( We include the pre-MBA income since you will not earn anything while studying and will lose the $60,000 you made before the MBA).

Assume your post-MBA salary is $100,000, an increase of $40,000.

Divide the entire cost of your MBA (US$220,000) by the income increase (US$40,000), and you’ll discover that your MBA will pay for itself in just over five years. After five years, your debt will be square, and here is when your MBA ROI comes into play.

When we think about ROI, we consider a ten-year ROI; therefore, what would the ROI be in ten years based on the example?

Want to pursue an MBA but not sure if your profile fits?

Talk to our Profile Experts to know your chances for a top MBA Program.

GET A FREE PROFILE ANALYSISYour MBA Program’s ROI in Ten Years

Multiply your post-MBA income (US$100,000) by ten years to get US$1,000,000.

Then, deduct ten years of your pre-MBA pay. In this scenario, it would be US$1,000,000 minus US$600,000, for a total of US$400,000.

Take the MBA cost out of this total, thus US$400,000 – US$220,000 to get your 10-year MBA ROI of US$180,000.

Let us explain the most basic technique of calculating ROI. To get a better idea, begin with a school-reported post-MBA income and then add percentage increases each year.

Top MBA Programs with the Highest Return on Investment (ROI) and How to Measure ROI of MBA Programs

1) Stanford Graduate School of Business offered MBA graduates an average starting salary of $ 200,000 and a tuition fee of $160,000. The return on investment over ten years is expected to be 340 percent.

2) Harvard Business School—Harvard Business School offers MBA graduates an average starting salary of $175,000, a total program cost of $146,000, and a 10-year ROI of 325 percent.

3) Imperial College Business School – The 10-year ROI is US$870,200, over 14 times greater than the average domestic tuition rate.

4) Ross Schools of Business—The institution’s 20-month course has a 10-year ROI of around US $826,300, and students were able to recoup their initial investment in 40 months following graduation.

| B-school | Tuition Fee** | Average Salary | 10 Year ROI |

|---|---|---|---|

| Tepper Business School | US $75,712 | US $156,291 | US $816,525 |

| MIT Sloan | US $86,550 | US $148,075 | US $788,950 |

| INSEAD | US $105,000 | US$113,700 | US$768,500 |

** not including other expenses.

To calculate the ROI of a program not listed here, fill out your information on GMAC’s official website and get your ROI computed: MBA ROI Calculator.

Predicting your initial salary and annual income raises post-MBA is straightforward, influenced by work experience, acquired knowledge, and job competence. Divide your MBA tuition by your wage increase to calculate loan repayment time. But in the end, you want to be certain that your time and tuition investment will pay off financially.

Understanding the ROI of an MBA program is crucial to avoid debt and make informed choices. Our MBA and beyond service assists candidates in evaluating their options effectively. Schedule a free profile evaluation now.

Frequently Asked Questions

01.

What is the ROI for an MBA?

Return on investment (ROI) is a performance statistic used to evaluate the efficiency or profitability of an investment or compare the efficiency of many projects. ROI seeks to directly quantify the amount of return on a certain investment, in this example, an MBA degree, concerning the cost of the investment.

02.

Why is ROI important?

Understanding the financial risks and rewards is essential to avoid unpleasant shocks after decision-making. An MBA degree often necessitates a substantial financial investment; although banks and financial entities offer school loans, one must consider this degree’s ROI.

03.

How do you calculate ROI for MBA?

The ideal approach for estimating the return on investment (ROI) of an MBA degree is to evaluate the annual pay increase and calculate how many years it will take to repay the student loan/investment through salary increases. Pre- and post-MBA work experience, EMIs, market conditions, and other considerations should all be considered.

04.

How much does an MBA increase your salary?

It all depends on the school you attend; some b-schools provide a 10-20% boost in your current and post-MBA pay, while others offer a 20-50% rise.

You can refer to the article for average salary pay for top B-school: Tier 1 vs. Tier 2 Business schools

Leave a Reply